The Government of Ghana has announced a breakthrough in the energy sector after successfully clearing a US$1.47 billion debt and restoring a US$500 million World Bank Partial Risk Guarantee, marking a significant turnaround for the country’s power industry.

The development, confirmed by the Ministry of Finance, is expected to strengthen investor confidence, stabilize electricity supply, and ease long-standing financial pressure within the energy value chain.

A Major Reset for the Energy Sector

According to government sources, the debt clearance was completed during the 2025 fiscal year, less than a year into President John Dramani Mahama’s administration. The arrears had accumulated over several years due to unpaid gas supplies and obligations to independent power producers.

At the time the new administration took office, the energy sector was burdened with legacy debts that threatened power generation and undermined contractual obligations with key partners.

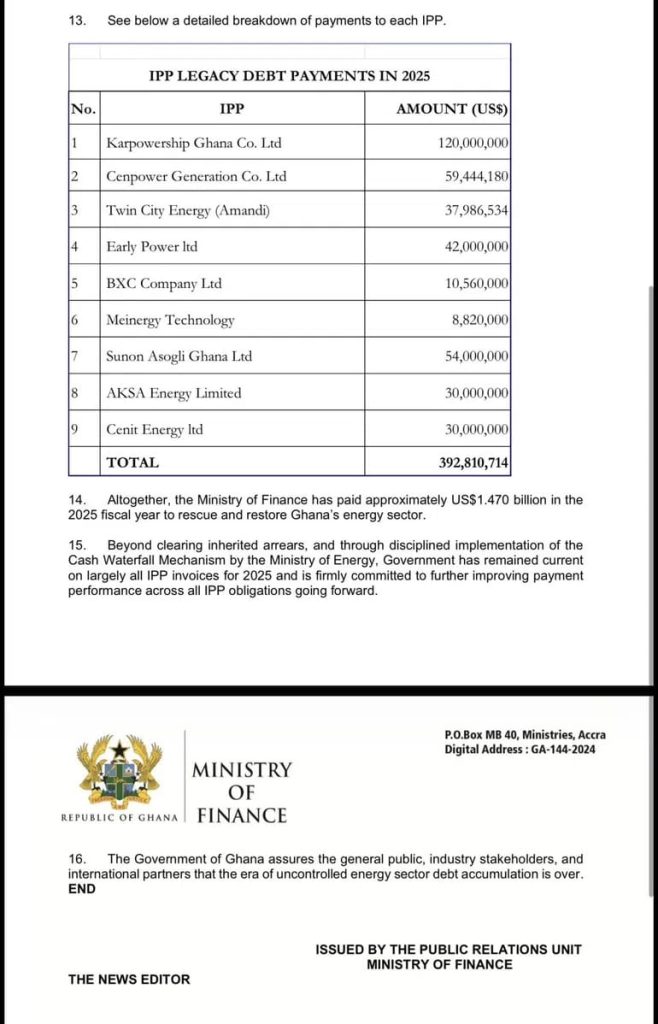

Breakdown of the $1.47bn Payment

Pulse reports that the total amount paid by government covered several critical obligations within the energy sector.

A significant portion was used to fully repay amounts drawn under the World Bank’s Partial Risk Guarantee, which had been depleted after government failed to meet payment obligations linked to gas supplied from the Offshore Cape Three Points (OCTP) project.

Additional payments were made to gas suppliers and independent power producers, including firms involved in thermal power generation, to settle outstanding invoices and bring accounts up to date.

Restoration of the World Bank Guarantee

One of the most important outcomes of the settlement is the full restoration of the US$500 million World Bank Partial Risk Guarantee. The guarantee plays a crucial role in protecting investors and lenders against payment risks in Ghana’s energy sector.

Its reinstatement signals renewed confidence in Ghana’s ability to meet contractual obligations and honor energy-related payments, a move analysts say could unlock fresh investment and financing opportunities.

Why the Deal Matters

The energy sector has long been one of Ghana’s most financially strained areas, with mounting debts often leading to power supply risks and higher costs to the state.

By clearing the arrears, government says it has removed a major threat to power stability and created space for better planning, improved cash flow, and more predictable operations across the sector.

Industry observers believe the move will also help prevent future power disruptions and support economic activity, especially for businesses dependent on reliable electricity.

Government’s Position Going Forward

The Ministry of Finance has indicated that measures are being put in place to prevent a recurrence of energy sector arrears, including improved payment structures and tighter financial controls.

Officials say the focus now is on sustaining discipline within the sector while ensuring that electricity generation remains reliable and affordable for consumers.

What It Means for Ghanaians

For households and businesses, debt clearance offers hope of a more stable power supply and reduced pressure on electricity tariffs in the long term.

For investors, the restored World Bank guarantee sends a strong signal that Ghana is committed to restoring credibility in its energy sector and honoring its financial commitments.